As one probably already knows, Federal Reserve Bank recently set the federal benchmark rate to the range of 0-0.25% on March 16 in an effort to boost up the economy which faces an upcoming economic turmoil as a result of COVID-19 pandemic. As the federal benchmark rate is the fundamental interest rate US central bank charges to commercial banks for short-term financial instruments, it will certainly affect consumer interest rates for mortgage loans, car loans, and etc.

In the past week, several clients asked Flagship Lending how this will affect their mortgage refinance rate, or if the mortgage rate for new purchase will become too high when they close a deal to buy a house in the short term. This article is intended to provide an historical view of the relationship between mortgage rate and federal benchmark rate. In specific, it tries to answer the following two questions:

- Is our mortgage interest rate going to drop to close to zero since federal benchmark rate now drops close to zero?

- What will the overall trend of mortgage rate in the next few months

As mentioned above, the federal benchmark rate is the fundamental interest rate US central bank charges to commercial banks for short-term liquidity instruments. When lending the money to end consumers, commercial banks/lenders bear the consumer credit risk and their view of systematic risk in the economy, which are their cost components. On top of that, they also need to ear a profit margin. Mortgage rate will NEVER drop to the level of federal benchmark rate level, simply because banks have to make money.

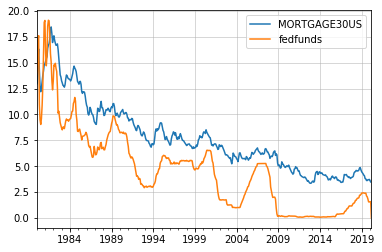

The following graph shows the trend of mortgage rate and federal benchmark rate after 2000. As shown, in the past economic recession in 2009, Federal Reserve also dropped to federal benchmark rate to near zero, but the average 30-year fixed mortgage rate dropped slowly (albeit to a less magnitude) and has been hovering around 4% for a few years. The difference between the mortgage rate and federal benchmark rate (or spread) reflects the cost and bank margin in consumer lending business. When the economic outlook gets worse, banks have a tendency to mark up their margin to compensate for the higher systematic risk in the economy. That explains why in the past a couple of weeks, all mortgage lenders increased their mortgage rates and the rate itself can change a few times in a single day.

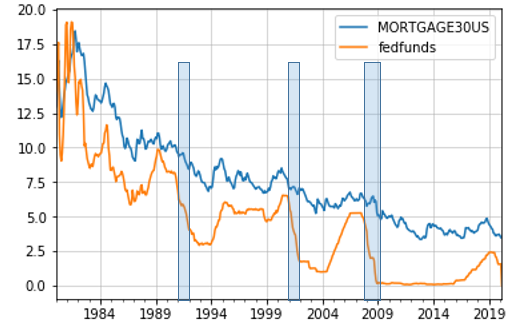

Looking forward, what the mortgage interest rate will go? This is a hard question to answer, but a longer historical view of the rates will probably provide some useful insights. The following is the same trend but starting from 1980, with three recent recession periods added (highlighted in blue bars). As shown below, at the start of economic recession periods, typically Federal Reserve Bank will drop the federal benchmark fund rate. The 30 year fixed mortgage rate will usually follow federal benchmark rate and drop. In the last recession around 2008-2009, the mortgage rate experienced a moderate rebound which was probably caused by the large uncertainty when the recession started, and then dropped and stabilized till recently.

The recent 10 years has witnessed historical low mortgage rate in the past couple of decades. Despite of recent jump/volatility in the past two weeks, the mortgage interest rate will continue to stay at a lower level in the short to mid team. Hopefully, COVID-19 will be under control soon, uncertainty in house/mortgage market will come down, and our borrowers will continue to enjoy a low mortgage interest rate.

Copyrighted materials 2020, Flagship Lending Inc.