This is a question clients have asked Flagship Lending from time to time. This short article is intended to shed some light on this topic. The quick answer is NO. The interest you’ve already paid has nothing to do with your decision whether to do the refinance or not. It is simply the price you should pay and have paid for borrowing the money thus far. The re-finance is justified if the new interest rare is lower enough to compensate for your refinance charge. Under some circumstances, lenders/brokers can cover most of the refinance cost. Here is an example when there is no refinance cost.

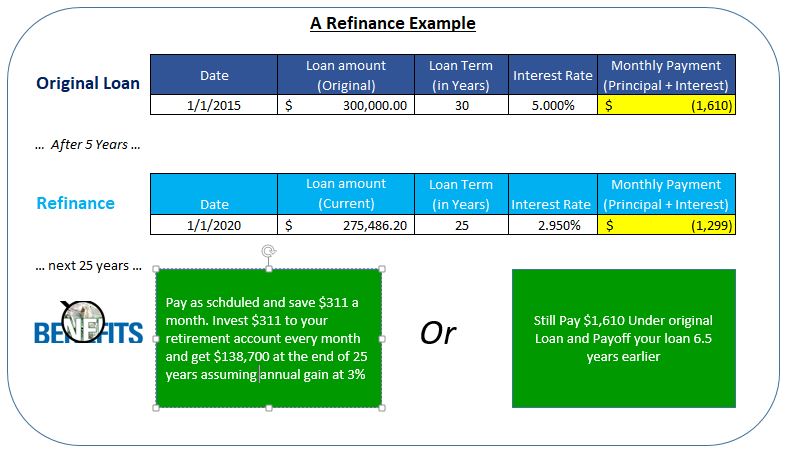

Original loan: with loan amount $300,000, 5% of fixed interest rate, and 30 years of term from 01/01/2015 to 01/01/2045. Your monthly payment is $1,610.

Now you have paid down your loan for 5 years. After 5 years, your loan balance will be $275,486 on 01/01/2020. Let’s say you decide to refinance your mortgage for another 25 years with rate @2.95% so that you pay-off date is the same as before — 01/01/2045. The new monthly payment will be $1,299 when refinanced. This is about $311 drop in your monthly payment. This the real benefit you get from refinancing your loan.

Without refinance: your total financial charge by the lender is 1,610*12*30-300,000 = $279,600 (same monthly payment for 30 years)

With refinance: You total financial charge is 1,610*12*5+1,299*12*25 – 300,000 = $186,300 (monthly payment of $1,610 for the first 5 years under the original mortgage and $1,299 for the another 25 years under re-finance contract).

The financial charge you pay to the bank is significantly lower with refinance. One can argue that the typically he will get another 30 year loan, and thus the debt will be extended for another 5 years. That is true, but you always have the option to pay off your loan ahead of time (let’s say, still on 01/01/2045, the original pay-off date), and thus paying less interest than the original mortgage. Or alternatively, after refinance, if you still choose to pay $1,610 as under the original contract, the loan will have zero balance around July 2038, which is about 6.5 years ahead of the pay-off date of the original mortgage.

In conclusion, interest rate should be the primary factor or golden standard when we compare loans with the same term. The term you pick (15, 20, 25, 30 years) really depends on the expected time you are expecting to stay in your current residence. With interest rate at a historically low, Flagship Lending Inc has seen more people choosing to lock in a low interest for a loan with longer term than people typically chose a few years ago.

Copyrighted materials 2019, Flagship Lending Inc. a